FHA Loan - Everything You Need to Know

The National Housing Act of 1934 created the Federal Housing Administration, which was established during the Great Depression when the rates of foreclosures and defaults had risen sharply.

This program allowed lower income Americans the ability to afford homes while at the same time being a self supporting government backed loan that allowed banks to lend without the worry of major default.

FHA Mission

Help people realize the "American Dream" of homeownership

Stabilize and Revitalize Communities

Promote Economic Growth

Reduce Defaults/Preserve Neighborhoods

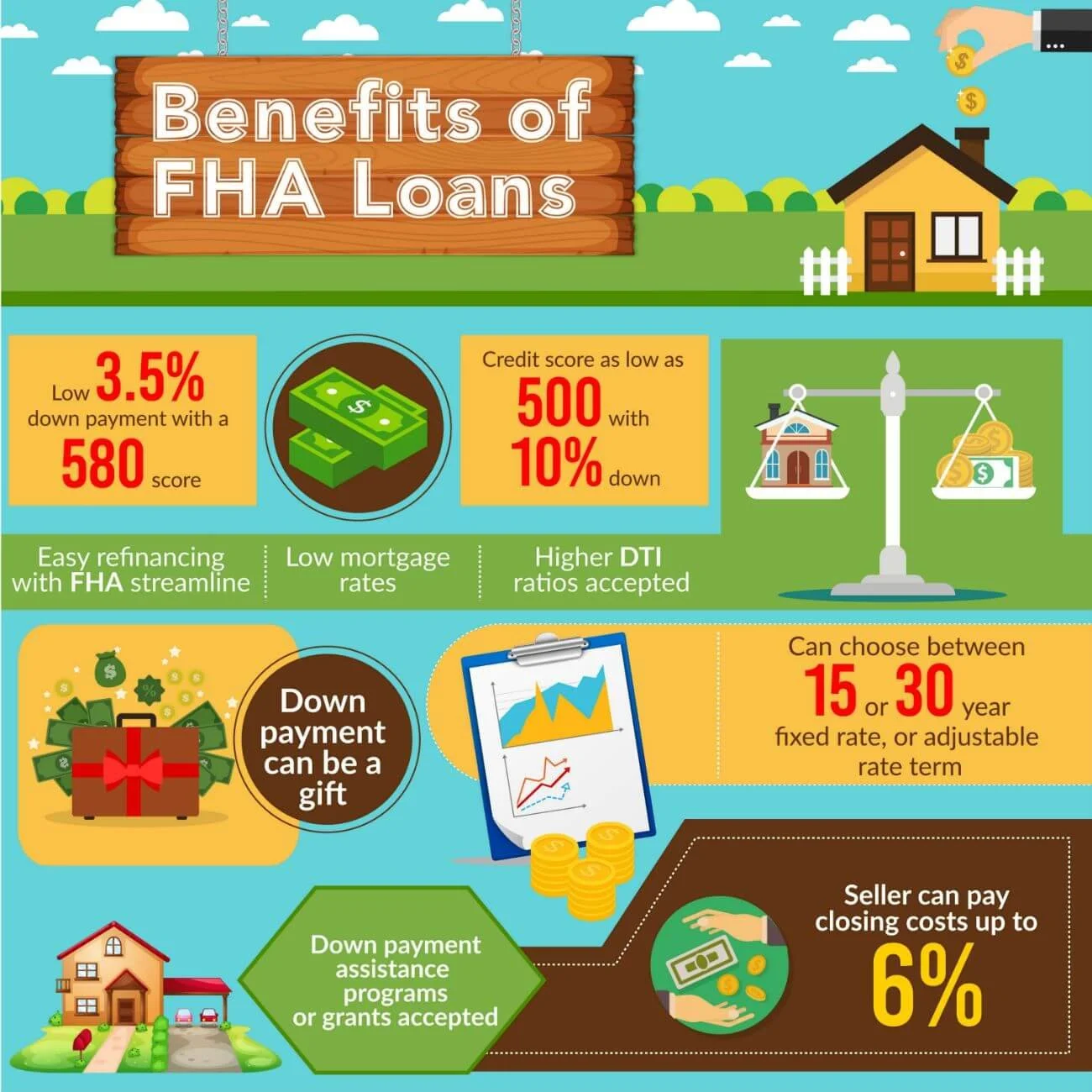

FHA Benefits

3.5% Down Payment

Government insured loan

Loan can be manually underwritten

More lenient FICO score and debt to income ratio.

More lenient guidelines on borrowers collection accounts, prior bankruptcies, foreclosures and shortsales.

More lenient seller contributions of up to 6%

Gift funds allowed

Non-occupant co-borrowers allowed

Flexible Credit Guidelines

FHA loans are known for being flexible with credit.

If little credit history exists, the borrower must obtain either a Non-traditional Mortgage Credit Report (NTMCR) or Independent Verification of Non-Traditional Credit Providers.

A buyer may have credit scores in the low 600's or a previous foreclosure, short sale, or bankruptcy. Therefore, for these reasons, buyers purchasing a primary residence should explore this product.

Conclusion

The FHA Loan is a great government loan with more lenient qualifications and allowing you to buy a home with as little as 3.5% down.

If you meet the credit score minimums (mentioned above), you should consider asking your mortgage lender about obtaining an FHA Loan.

If you don't have a lender contact me to refer you to a quality lender that will work with you every step of the way through the buying process.